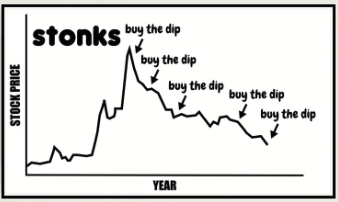

We've all been there, after a huge dip in a security (or the market in general), everything starts to look "cheap" relative to a day earlier. "wow I can't believe $NVDA is trading at under $100 right now, it was almost $150 last week!", the next thing you know, you pulled the trigger and bought $NVDA with all available cash.

In the industry, we call this "catching the falling knife", if you visualize it, it's akin to a circus performer catching a giant knife after throwing it in mid air - the difference is, you're not a circus performer. Can you catch the knife? Certainly, but would you bet on that? I wouldn't.

The psycology of the market is that, people tend to have short term memories, they always look at something RELATIVE to what it was a few minutes/hours/days ago. When something dips significantly, let's say from an bad earnings report, people tend to buy it immediately because the price is "cheap" (no such thing, because a stock can be priced at 2 cents and when it drops to 1 cent, you just lost 50% of your money), what they didn't take account for is the fundamental changes to the company (CEO leaves, closing of stores, significant sales drop etc).

In defense of dip buying

Now I'm not saying to never buy dips, there are certainly situations where a stock can drop "too much" (put that in quotes because the definition of too much is very subjective). Think of the market as your crazy neighbor, who one day wants to sell his house at 500k, and then the next day at 900k. People panic, and when they panic, they make bad decisions, and your job is to capitalize on those bad decisions when the price is attractive to you. The market is owned by algos and big players, retail traders made up a small portion of the market participants, so when something dips 20%, it's most likely the results of big players selling a large position - forced liquidations, force selling of the assets out of the seller's control, they are FORCED to sell at a price in order to cover their margin obligations. Buying in those situaions can sometimes be lucrative due to temporary mispricing.

My rules for dip buying

I never buy dips on the first day of the big drop, it's a simple conclusion from over 10 years of personal market observation. What usually happens is, something drops, it bounces a little (all the initial dip buyers), then it continues to drop further after the initial sellers found more suckers to sell them to at higher price. The other explanation is, after the first dip (usually from forced liquidation of longs), those traders open up a new long position at the dipped price, the leveraged longs creates a upwards price action temporarily, they sell at a small profit and drive the price down, and with the absence of longs, the price dips further than before. As much as I find this interesting, I have absolutely no desire of participating in that mess. That's why I have a personal rule of waiting at least 3 days before buying any dip. I want to let these guys play their little games and for the market to calm itself before I personally participate in it.

I never buy dips on the first day of the big drop, it's a simple conclusion from over 10 years of personal market observation. What usually happens is, something drops, it bounces a little (all the initial dip buyers), then it continues to drop further after the initial sellers found more suckers to sell them to at higher price. The other explanation is, after the first dip (usually from forced liquidation of longs), those traders open up a new long position at the dipped price, the leveraged longs creates a upwards price action temporarily, they sell at a small profit and drive the price down, and with the absence of longs, the price dips further than before. As much as I find this interesting, I have absolutely no desire of participating in that mess. That's why I have a personal rule of waiting at least 3 days before buying any dip. I want to let these guys play their little games and for the market to calm itself before I personally participate in it.

Never deploy all your capital in a single trade because why give yourself only one chance to buy it correctly? Ladder it out, buy with 20% of your cash on the first go, if it goes lower, buy with the next 20%, until you have deployed all of your capital. This gives you a few chances to be wrong. Of course, the downside of this is, if the stock reverses immediately and continues upwards (THIS HAPPENS VERY RARELY) then you have missed out on more gains.

Is this strategy fool proof? Absolutely not, violent drops can sometimes be followed by violent bounces. Timing the market is HARD, you'd get it wrong more often than right. It is astronomically harder to timing it right on the first day than the days follow, it's been working for me and I hope it'll work for you.